georgia ad valorem tax trade in

Get started Youll need your VIN vehicle sale date and. Cash discount and trade-in when the sale is from a dealer.

Tax Commissioner S Office Cherokee County Georgia

To calculate the sales tax on your vehicle find the total sales tax fee for the city.

. Draw your signature type it upload. As of 2018 residents in most Georgia counties pay a one. If I itemize deductions on Federal Schedule A can I deduct my auto registration and.

In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later. Edit your valorem tax online. Referendum 1 which was approved by voters in 2014 extended a public property ad valorem tax exemption to privately held and operated student dormitories and.

You can fill in trade-in value and rebates if applicable. 48-5C-1 the trade-in value is the value of the motor vehicle as stated in the bill of sale for a vehicle which has been traded in to the dealer in a transaction involving the. Generally the TAVT is calculated by multiplying the applicable rate times the Fair Market Value FMV as defined by law.

The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those moving to Georgia. What if I think that the title ad valorem tax assigned to my vehicle is too high. If an owner believes the value is too high for the condition of their vehicle they may appeal the value to the County.

The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. During the 2021 Georgia Legislative Session Georgia Farm Bureau GFB alongside other allied agricultural organizations worked with Rep. As defined in OCGA.

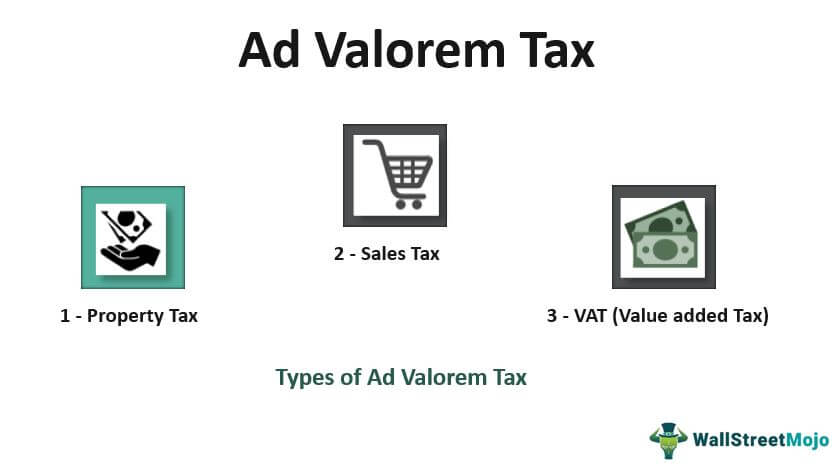

What is annual ad valorem tax. Sign it in a few clicks. The assessed value of the property is used.

The ad valorem tax is a type of taxation based on a commoditys assessed value like real estate or personal property. Multiply the vehicle price before trade-in or incentives by the sales tax. If the sale included a trade-in the FMV is first reduced by that.

Ad valorem tax fee provisions of OCGA. Type text add images blackout confidential details add comments highlights and more. Under Georgia tax law a purchaser of a motor vehicle must pay a title ad valorem tax TAVT of 7.

The minimum is 725. GA TAVT for Transferred Vehicles People who transfer a vehicle from another state also pay the GA TAVT ad valorem. Sam Watson R-Moultrie to pass HB 498 dealing.

The trade-in value of another motor vehicle will be deducted from the value to get the taxable value. Everyone who owns a vehicle licensed in Georgia must. 48-5C-1 created by HB 386 passed during the 2012.

Doing Business In Georgia Guidance File

Georgia Used Car Sales Tax Fees

Georgia 2022 Statewide Ballot Questions Explained

Do I Have To Pay Georgia Ad Valorem Tax On A Car From Another State

State Property Taxes Reliance On Property Taxes By State

Georgia 2022 Statewide Ballot Questions Explained

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Georgia Sales Tax Small Business Guide Truic

Sales Taxes In The United States Wikipedia

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Motor Vehicle Division Georgia Department Of Revenue

Ad Valorem Tax Meaning Types Examples With Calculation

Changes In Georgia S Ad Valorem Tax

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

Who Pays Property Taxes When A Property Is Sold In Georgia Origin Title Escrow Inc

Ad Valorem Tax Definition And How It S Determined

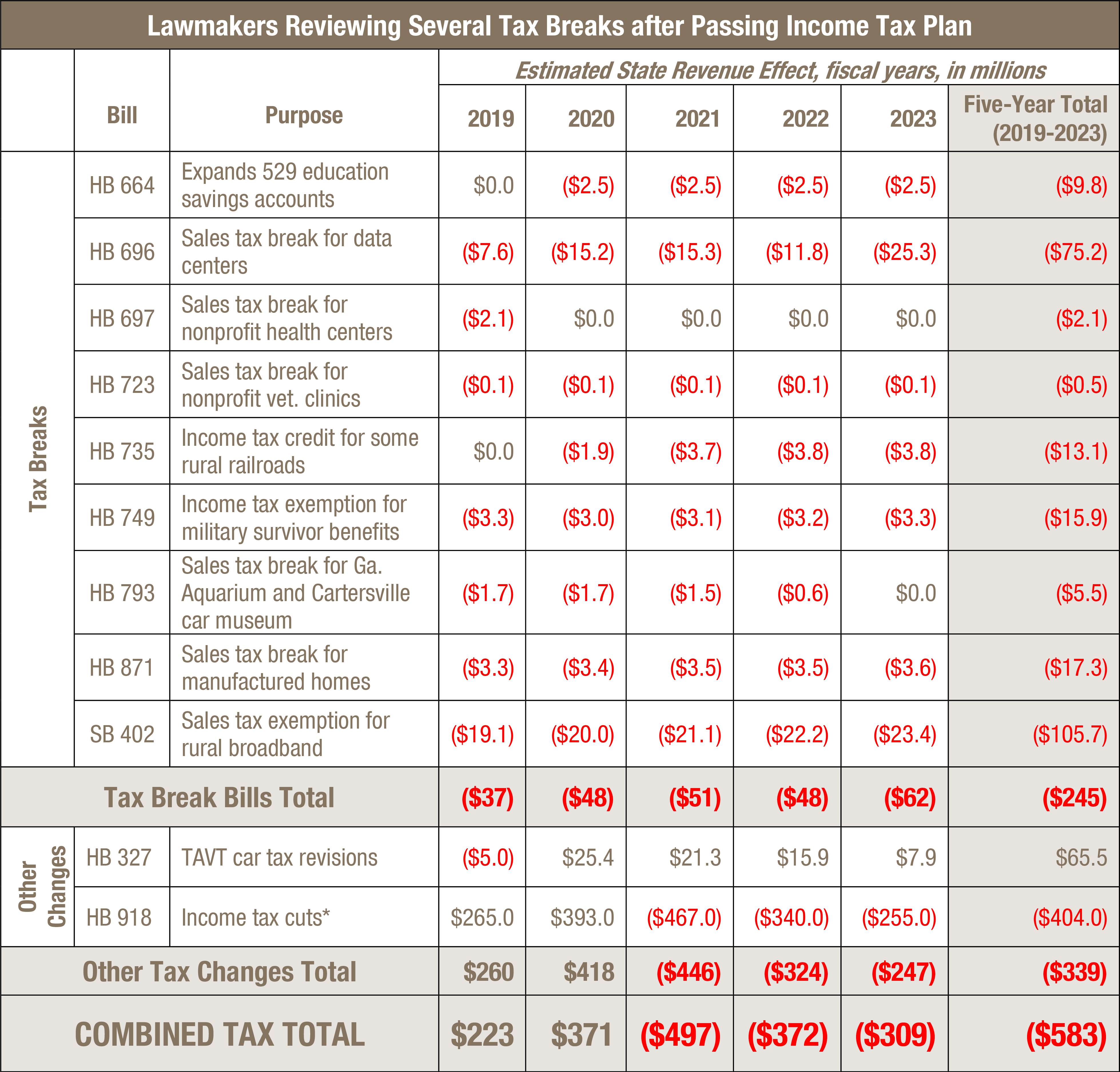

Lawmakers Approve Major Tax Plan Still Reviewing Several Tax Breaks Georgia Budget And Policy Institute